The Offshore Account Ideas

An offshore financial institution account is usually used by those that have little faith in their local banking industry or economic situation, those who reside in a less politically stable country, those that can legally avoid taxes in their new country by not paying funds to it, as well as expats who want one centralised bank account source for their worldwide financial needs.

Retaining a financial institution account in a country of domicile makes considerable and also long-lasting sense for many expatriates. Unless you're trying to change your country of domicile as well as sever all connections with your residence country for life, preserving a banking visibility there will certainly mean that if ever you intend to repatriate, the path will certainly be smoother for you.

Your company may demand you have such an account right into which your income can be paid each month. You might also need such an account to have utilities attached to your brand-new residential or commercial property, to get a smart phone, rent a house, increase a mortgage or buy a vehicle.

Getting My Offshore Account To Work

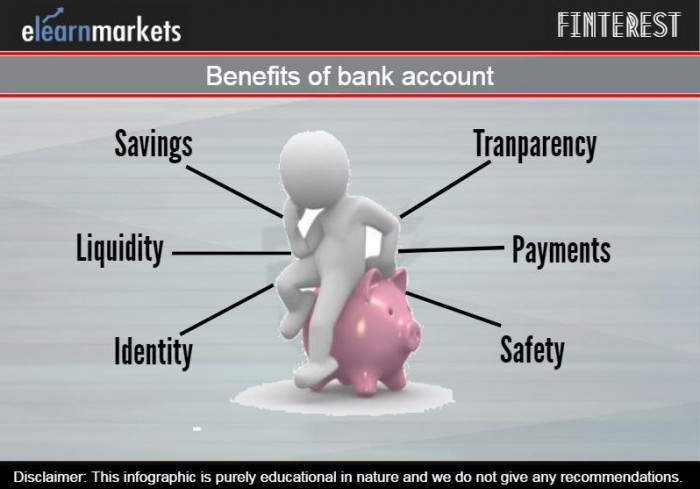

The main point to keep in mind is that overseas banking isn't always a best solution for each expat. It is necessary to understand what advantages as well as drawbacks overseas banking has and also exactly how it suits your individual situation. To help you determine whether an overseas savings account is appropriate for you, right here are the most prominent advantages and downsides of offshore banking.

If the country in which you live has a much less than good financial climate, by keeping your wide range in an offshore savings account you can prevent the risks in your new nation such as high inflation, money decrease or perhaps a successful stroke or war. For those expats residing in a nation where you just pay tax obligation on the money you pay into that nation, there is an apparent tax obligation advantage to keeping your cash in an overseas savings account.

Deportees can take advantage of this no matter where they are in the globe as it can imply they can access their funds from Atm machines or online or over the phone at any type of time of the day or night, whatever the time area. Any type of interest made is usually paid without the reduction of taxes.

Offshore Account - Questions

Keep in mind: professional estate planning advice requires to be looked for by any individual looking for to gain from such a benefit. Some offshore banks bill much less and some pay even more interest than onshore banks. This is coming to be less and also much less the case nowadays, however it's worth looking closely at what's offered when looking for to establish a new offshore checking account. offshore account.

Less government intervention in offshore monetary centres can imply that overseas financial institutions have the ability to supply more fascinating investment services and also remedies to their clients. You might take advantage of having a connection manager or exclusive financial institution account manager if you select a premier or private offshore savings account. Such a solution is of advantage to those that prefer an even more hands-on approach to their account's administration from their bank.

as well as visit their website enable you to wait on a specific rate prior to making the transfer. Historically financial offshore is arguably riskier than banking onshore. This is shown when checking out the results from the Kaupthing Singer and Friedlander collapse on the Isle of Male. Those onshore in the UK that were influenced in your area by the nationalisation of the financial institution's moms and dad firm in Iceland obtained complete settlement.

The term 'offshore' has actually ended up being identified with prohibited and also immoral cash laundering and also tax obligation evasion activity. As a result possibly anybody with an offshore checking account can be tarred, by some, with the exact same brush despite the fact that their overseas financial activity is wholly reputable (offshore account). You have more information to pick your offshore jurisdiction thoroughly.

Not known Factual Statements About Offshore Account

It's crucial to look at the terms and conditions of an offshore financial institution account. It can be more difficult to fix any type of problems that might arise with your account if you hold it offshore.

We wish this open as well as ever-developing checklist of the advantages as well as downsides of offshore financial will certainly assist you to comprise your very own mind concerning whether an overseas checking account is ideal for you. The Deportee Guide to UK Pensions Abroad what alternatives you have for your UK pension pot when you retire abroad, tax obligation effects of leaving your pension plan in the UK or moving it abroad, how you can reduce your tax obligation liabilities, your UK state pension, etc.Expat Financial Questions Answered By A Specialist Riches Supervisor FAQs about moving to Europe after Brexit: your tax responsibilities, currency worries, pension choices, will, estate planning, financial savings and also financial investments, and also, more.Offshore Profile Bonds Explained what you need to find out about overseas portfolio bonds prior to considering them as an investment option.Banking, Conserving, & Investments Abroad your banking as well as financial investment options broaden when you come to be an expat. And in addition to abiding by these durable criteria, expats may still have the ability totake pleasure in more personal privacy from an overseas bank than they can from an onshore one. Around the clock help if something fails, with access to telephone as well as on the internet financial 24 hr a day, 7 days a week, 365 days of the year -generally come as criterion - offshore account. As a matter of fact, this factor alone is sufficient for lots of people to open an offshore checking account. There can be expat tax obligation advantages to using an offshore financial institution -yet whether these use in your case will certainly depend on your personal situations, such as nation of residence. Also, some account holders who bank in jurisdictions like the Island of Guy as well as Jacket, as an example, can select to obtain interest on their financial savings look at here now tax obligation totally free. As a deportee, this gets rid of the demand to recover tax obligation paid, as well as avoids the problem of reconciling your income tax return to ensure you are not over-paying tax.

Comments on “Fascination About Offshore Account”